What’s Ahead For Mortgage Rates This Week – September 8th, 2025

The release of major inflation data has once again arrived with the Consumer Price Index and the Producer Price Index, offering insight into the current state of the economy. Based on recent statements from the Federal Reserve, there is considerable speculation that rate cuts may occur regardless of the trajectory of inflation.

More recent data releases have shown that the economy is still on shaky ground after changes to tariff policies, leading things to be more unstable than anticipated. Trade deficits have also shown to have bounced back significantly from the prior months, while the manufacturing side are still showing impacts from the tariffs. Jobless Claims have also hit the highest levels since June, giving some concern to the broader labor market.

Trade Deficit

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $78.3 billion in July, up $19.2 billion from $59.1 billion in June, revised.

Manufacturing PMI

The trade wars are slowly dying down. The damage to American manufacturers is not. Industrial production fell in August for the sixth month in a row, according to an index compiled by the Institute for Supply Management. The ISM surveys executives every month about how their businesses are doing.

Job Reports

The number of people who applied for unemployment benefits in the seven days ended Aug. 30 rose by 8,000 to 237,000, the Labor Department said Thursday. It is the highest level since late June. Economists polled by The Wall Street Journal had estimated new claims would rise by 2,000 to 231,000.

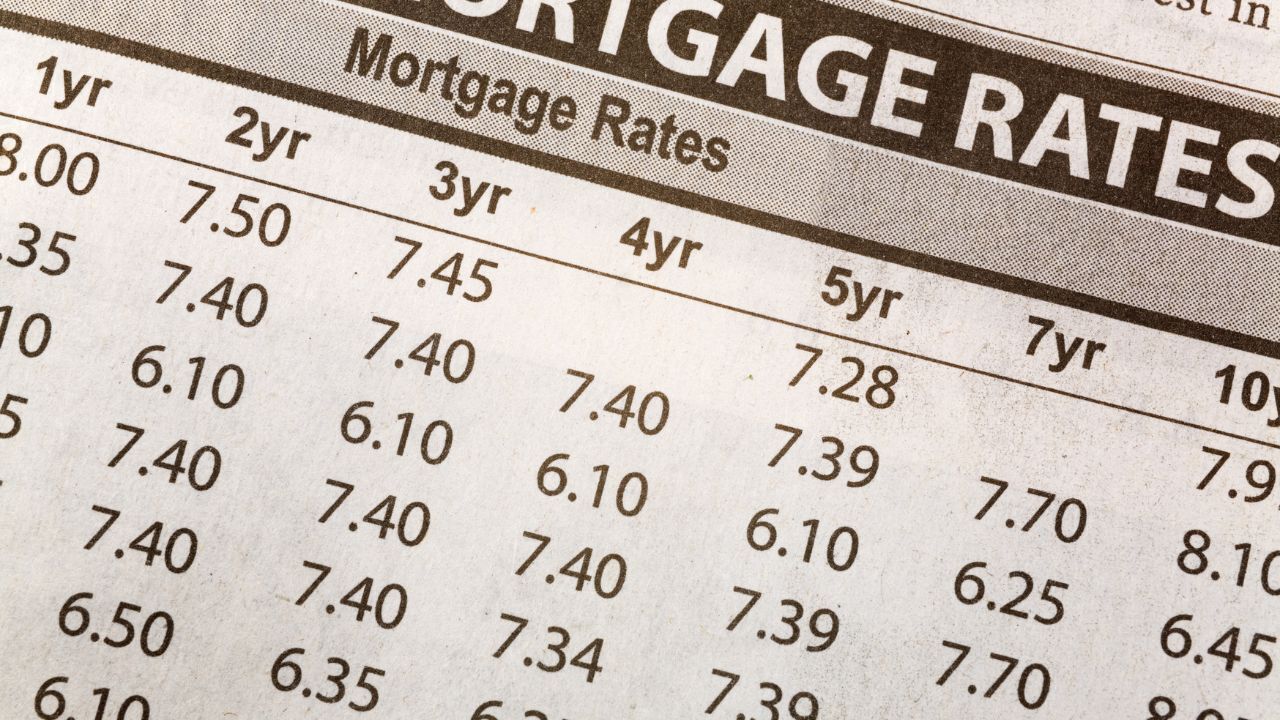

Primary Mortgage Market Survey Index

• 15-Yr FRM rates saw a decrease of -0.09% for this week, with the current rate at 5.60%

• 30-Yr FRM rates saw a decrease of -0.06%, with the current rate at 6.50%

MND Rate Index

• 30-Yr FHA rates saw a decrease of -0.11% for this week. Current rates at 5.95%

• 30-Yr VA rates saw a decrease of -0.11% for this week. Current rates at 5.97%

Jobless Claims

Initial Claims were reported to be 237,000 compared to the expected claims of 230,000. The prior week landed at 229,000.

What’s Ahead

Upcoming reports include the CPI and PPI inflation data, along with the University of Michigan Consumer Sentiment Report, which will close out the week.

The rise of cryptocurrency and digital assets has transformed the way many people invest and build wealth. As more buyers hold Bitcoin, Ethereum, and other digital currencies, the question of how these assets impact mortgage approval has become more common. While lenders are beginning to recognize cryptocurrency, it is still a developing area that requires careful planning.

The rise of cryptocurrency and digital assets has transformed the way many people invest and build wealth. As more buyers hold Bitcoin, Ethereum, and other digital currencies, the question of how these assets impact mortgage approval has become more common. While lenders are beginning to recognize cryptocurrency, it is still a developing area that requires careful planning.