What to Expect at Your First Mortgage Appointment

Meeting with a lender for the first time is a big step in your homebuying journey. Whether you are buying your first home or upgrading to your next one, your mortgage appointment sets the stage for what comes next. Knowing what to expect helps you feel confident, prepared, and ready to make the most of that important conversation.

Meeting with a lender for the first time is a big step in your homebuying journey. Whether you are buying your first home or upgrading to your next one, your mortgage appointment sets the stage for what comes next. Knowing what to expect helps you feel confident, prepared, and ready to make the most of that important conversation.

Gathering Your Financial Information

Before your appointment, your lender will want to review your financial details. This includes your recent pay stubs, W-2 forms, tax returns, bank statements, and records of any debts or assets. Having these documents ready helps your lender get an accurate picture of your financial situation and makes the process smoother from the start.

Discussing Your Goals

Your first meeting is not just about numbers. It is also about understanding your homeownership goals. Be ready to talk about the type of home you want, your preferred price range, and how long you plan to stay in the property. Your lender will use this information to recommend loan options that fit your short-term and long-term financial goals.

Reviewing Credit and Loan Options

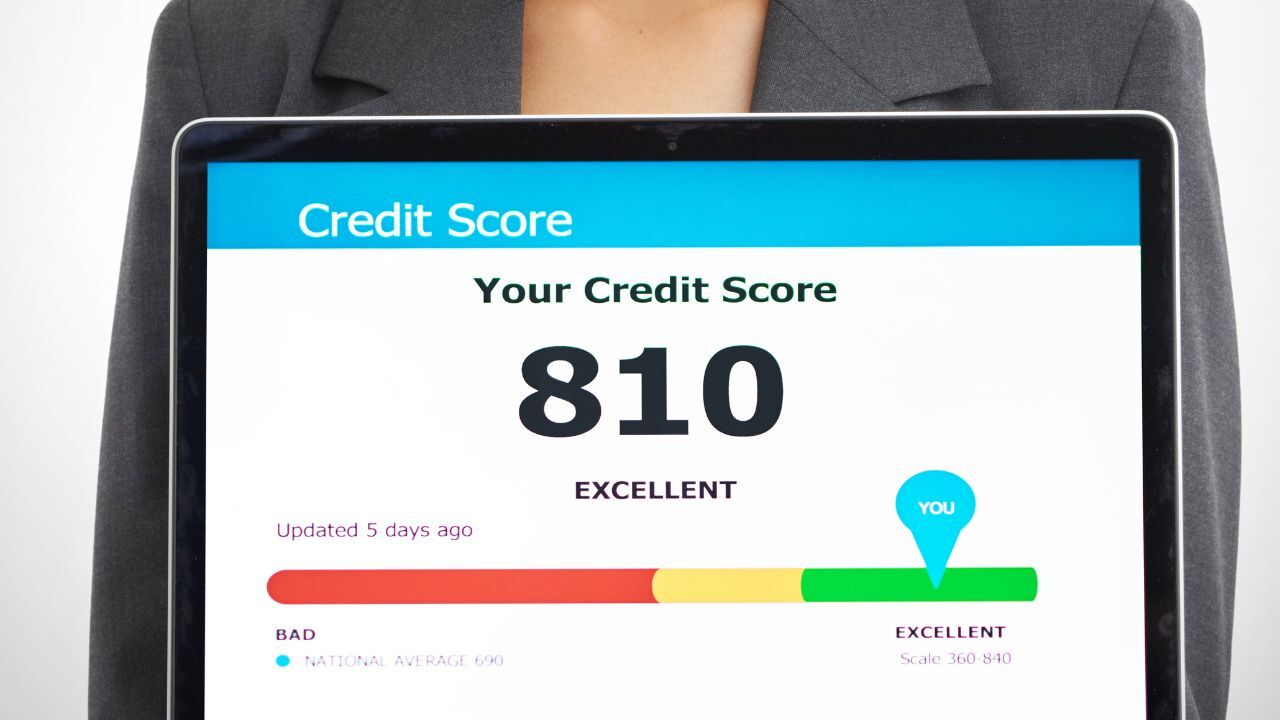

Your lender will review your credit report and explain how your score affects your loan eligibility and interest rate. They will walk you through different loan programs, including conventional, FHA, and VA loans, and outline the pros and cons of each. This is your chance to ask questions and understand how each option aligns with your financial comfort level.

Understanding Your Budget

One of the most valuable parts of your first mortgage appointment is learning how much home you can afford. Your lender will estimate your potential loan amount based on your income, debt, and down payment. They will also help you understand how monthly payments, interest rates, and closing costs fit into your budget so that you can make informed decisions moving forward.

Next Steps After the Appointment

At the end of the meeting, your lender will outline the next steps in the process. This may include getting prequalified or preapproved, gathering additional documentation, or reviewing your credit in more detail. You will leave the appointment with a clear action plan and a stronger understanding of what it will take to become a homeowner.

Your first mortgage appointment is about building clarity and confidence. When you come prepared and ask questions, you set yourself up for a successful start to your homebuying journey.

One of the first questions homebuyers ask is how much they can afford to borrow. While the number may seem mysterious, lenders use a clear set of financial factors to decide how much you qualify for.

One of the first questions homebuyers ask is how much they can afford to borrow. While the number may seem mysterious, lenders use a clear set of financial factors to decide how much you qualify for.  Buying a home is one of the most exciting goals you can set, but your credit score plays a major role in how easy or challenging the process will be. The good news is that with time and planning, you can strengthen your credit and set yourself up for a smoother approval when you are ready to buy next year.

Buying a home is one of the most exciting goals you can set, but your credit score plays a major role in how easy or challenging the process will be. The good news is that with time and planning, you can strengthen your credit and set yourself up for a smoother approval when you are ready to buy next year.