How the Purchase and Refinance Mortgage Process Works

When it comes to home financing, purchasing and refinancing a mortgage share similarities but serve distinct purposes. Understanding how each process works can help you make informed decisions about homeownership and financial planning.

When it comes to home financing, purchasing and refinancing a mortgage share similarities but serve distinct purposes. Understanding how each process works can help you make informed decisions about homeownership and financial planning.

The Purchase Mortgage Process

Buying a home starts with assessing your budget. Before house hunting, it’s crucial to determine how much you can afford by evaluating your income, expenses, and existing debts. Getting pre-approved for a mortgage will give you a clear picture of your budget and strengthen your offer when you find the right home.

Once you identify the perfect property, you make an offer, which includes price and contingencies such as inspections and financing approval. If the seller accepts, you apply for a mortgage by providing documentation on your income, assets, and credit history. After approval, you attend a closing to finalize the sale, sign paperwork, and pay closing costs.

The Refinance Mortgage Process

Refinancing replaces your current mortgage with a new one, typically to achieve lower monthly payments, adjust the loan term, or tap into home equity. The process begins by setting clear financial goals—whether you want to secure a lower interest rate or access cash for major expenses.

Similar to purchasing, refinancing requires documentation on income, assets, and credit history. After gathering this information, you compare lenders to find the best refinance option. Once you select a lender, you submit a loan application, undergo an appraisal if necessary, and finalize the new loan at closing, paying any applicable closing costs.

Key Differences Between Purchase and Refinance

While purchasing involves acquiring a property, refinancing is about optimizing an existing loan. The purchase process depends on market conditions and property availability, whereas refinancing is often driven by financial goals and interest rate trends. Additionally, refinancing tends to have lower closing costs than a home purchase.

Both processes require careful planning and the guidance of a trusted lender. Whether you’re buying your dream home or refinancing for better terms, understanding these steps ensures a smooth and beneficial mortgage experience.

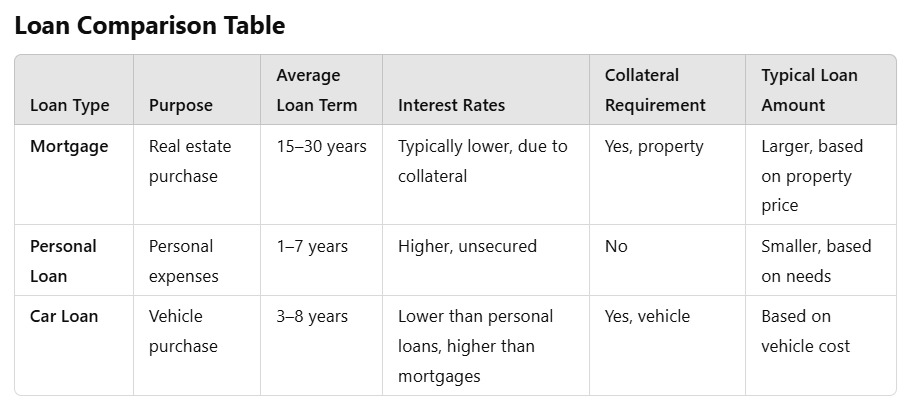

Planning to buy a home, finance a car, or cover unexpected expenses? Many loan options exist to help you achieve your financial goals, but choosing the right one can be challenging. Here’s a breakdown of the most popular types of loans, their unique characteristics, and what you need to know to make the best choice for your financial future.

Planning to buy a home, finance a car, or cover unexpected expenses? Many loan options exist to help you achieve your financial goals, but choosing the right one can be challenging. Here’s a breakdown of the most popular types of loans, their unique characteristics, and what you need to know to make the best choice for your financial future.

If you’ve received your Closing Disclosure from your lender, congratulations! You’re almost at the finish line of your home buying journey, ready to celebrate with keys in hand. The Closing Disclosure, or CD, is provided at least three business days before your closing appointment and details your loan terms, projected monthly payments, and the much-discussed “cash to close.” But what exactly is “cash to close,” and how is it calculated?

If you’ve received your Closing Disclosure from your lender, congratulations! You’re almost at the finish line of your home buying journey, ready to celebrate with keys in hand. The Closing Disclosure, or CD, is provided at least three business days before your closing appointment and details your loan terms, projected monthly payments, and the much-discussed “cash to close.” But what exactly is “cash to close,” and how is it calculated?