What’s the Difference Between a Second Mortgage and a Home Equity Loan?

If you’ve been diligently paying down your mortgage, you’ve likely built up a valuable asset: home equity. This financial resource can be a game-changer, offering opportunities to fund major expenses, consolidate debt, or tackle unexpected financial challenges. But with multiple borrowing options tied to your home equity, it’s essential to know which route aligns best with your goals.

If you’ve been diligently paying down your mortgage, you’ve likely built up a valuable asset: home equity. This financial resource can be a game-changer, offering opportunities to fund major expenses, consolidate debt, or tackle unexpected financial challenges. But with multiple borrowing options tied to your home equity, it’s essential to know which route aligns best with your goals.

Two popular options are second mortgages and home equity loans and often leave homeowners wondering about their differences. Let’s break it down to help you make an informed decision.

What is a Second Mortgage?

A second mortgage is any loan that uses your home’s equity as collateral while existing alongside your primary mortgage. Common types include home equity loans and home equity lines of credit (HELOCs). Both provide access to your equity but differ in structure and flexibility.

Understanding Home Equity Loans

A home equity loan offers a lump sum payment at a fixed interest rate. This setup is ideal for homeowners with a specific, one-time expense in mind, such as a home renovation, medical bill, or education costs. With predictable monthly payments, budgeting becomes straightforward, making this a popular choice for those who value stability.

Pros:

-

Fixed interest rate ensures consistent payments.

-

Suitable for large, single-purpose expenses.

Cons:

-

Less flexible—borrowers receive a one-time lump sum.

-

Interest starts accruing immediately on the full amount.

-

Exploring HELOCs

-

A HELOC, or home equity line of credit, functions like a credit card tied to your home’s equity. You’re approved for a credit limit and can withdraw funds as needed during a draw period, typically 5–10 years. This option is excellent for ongoing or variable expenses, like managing a business or funding multiple home improvement projects.

Pros:

-

Flexible access to funds over time.

-

Interest accrues only on the amount borrowed.

Cons:

-

Variable interest rates can lead to fluctuating payments.

-

Requires disciplined spending to avoid overborrowing.

-

The Key Consideration: Your Home is Collateral

Both options offer lower interest rates than unsecured loans or credit cards, making them cost-effective solutions for many homeowners. However, remember that your home serves as collateral. Missing payments could result in foreclosure, making it crucial to borrow responsibly.

Which Option is Right for You?

The choice between a second mortgage and a home equity loan depends on your financial needs and goals:

Opt for a home equity loan if you prefer stability and have a specific expense in mind.

Choose a HELOC if you need ongoing access to funds with flexible repayment options.

If you’re still uncertain, consulting a trusted mortgage professional can provide clarity and ensure you select the best path for your unique situation.

Putting Your Equity to Work

Your home equity is a powerful tool, but leveraging it wisely requires careful consideration. By understanding the differences between a second mortgage and a home equity loan, you’re one step closer to achieving your financial goals with confidence.

If you need more guidance tailored to your situation, reach out todayI’, we are here to help you make informed decisions and maximize the value of your home equity.

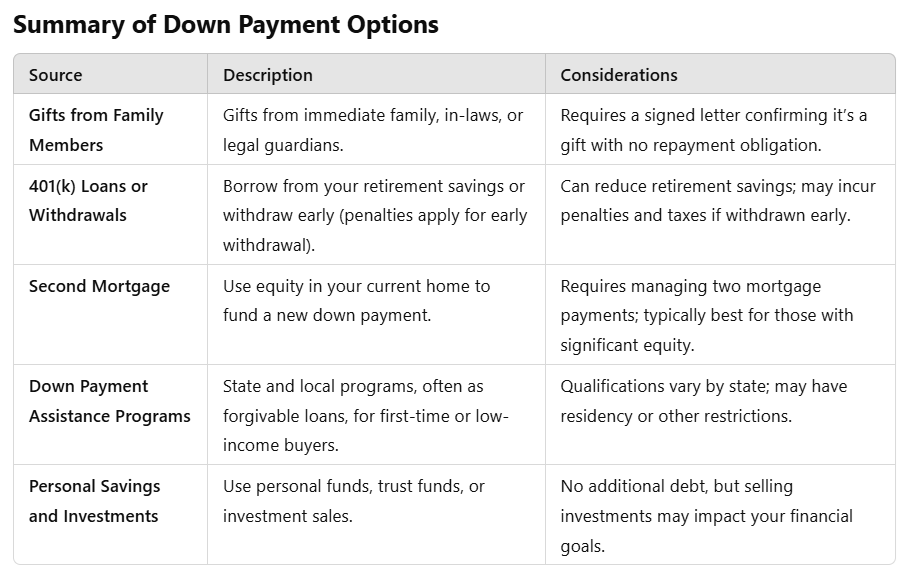

Buying a home is a big milestone, and for many, saving for a down payment can feel like a major hurdle. Fortunately, there are several ways to make that down payment happen. Whether through savings, family gifts, 401(k) funds, or even second mortgages, understanding your options is key to making the best financial choice. Let’s break down each of these options so you can explore what works best for you.

Buying a home is a big milestone, and for many, saving for a down payment can feel like a major hurdle. Fortunately, there are several ways to make that down payment happen. Whether through savings, family gifts, 401(k) funds, or even second mortgages, understanding your options is key to making the best financial choice. Let’s break down each of these options so you can explore what works best for you.

A closed-end second mortgage is a type of loan that allows a borrower to obtain a lump sum of money using their home as collateral. It is considered a “second” mortgage because it is taken out in addition to the borrower’s primary mortgage.

A closed-end second mortgage is a type of loan that allows a borrower to obtain a lump sum of money using their home as collateral. It is considered a “second” mortgage because it is taken out in addition to the borrower’s primary mortgage.