Smart Ways to Protect Your Credit Score Before Applying for a Mortgage

Your credit score plays a major role in the mortgage process. It helps determine whether you qualify for a loan, how much you can borrow, and the interest rate you may receive. Even small changes to your credit profile can impact your long-term cost of homeownership. The good news is that there are clear steps you can take to protect your score and position yourself for better mortgage options.

Your credit score plays a major role in the mortgage process. It helps determine whether you qualify for a loan, how much you can borrow, and the interest rate you may receive. Even small changes to your credit profile can impact your long-term cost of homeownership. The good news is that there are clear steps you can take to protect your score and position yourself for better mortgage options.

Pay Every Bill On Time

Payment history is one of the most influential factors in your credit score. Late or missed payments can cause immediate damage and may remain on your credit report for years. Setting up automatic payments or reminders can help ensure every bill is paid on time.

Keep Credit Card Balances Low

Credit utilization refers to how much of your available credit you are using. High balances can negatively impact your score even if payments are made on time. Keeping balances well below your total credit limits shows lenders that you manage credit responsibly.

Avoid Opening New Credit Accounts

Applying for new credit cards or loans can temporarily lower your score due to hard inquiries and changes in account age. If you are planning to apply for a mortgage, it is best to avoid opening new accounts unless absolutely necessary.

Do Not Close Long-Term Credit Accounts

The length of your credit history matters. Closing older accounts can shorten your credit profile and reduce available credit. Even if you no longer use a card often, keeping long-term accounts open can support a stronger score.

Review Your Credit Reports Regularly

Mistakes on credit reports are more common than many people realize. Reviewing your reports allows you to identify errors such as incorrect balances or accounts that do not belong to you. Addressing issues early can prevent unnecessary problems during the mortgage process.

Pause Large Purchases During the Loan Process

Once you begin the mortgage process, financial stability is critical. Large purchases can increase debt or change your credit utilization, which may affect loan approval. Waiting until after closing helps keep everything on track.

Speak With a Mortgage Professional Early

Connecting with a mortgage originator early allows you to understand how your credit profile impacts your options. You can receive guidance on what to improve, what to avoid, and how to prepare for the most competitive rates. Early planning often leads to better outcomes.

Protecting your credit score is not only about qualifying for a mortgage, it is about saving money over time. Strong credit can mean lower monthly payments and greater financial flexibility. With the right habits and guidance, you can take control of your credit and your home buying future.

When you are ready to buy a home, it is natural to shop around for the best mortgage rate and terms. But you may have heard that submitting multiple loan applications can damage your credit score and throw a wrench in your homebuying plans. Here is the truth behind hard inquiries, rate shopping, and how to protect your credit while securing the best deal.

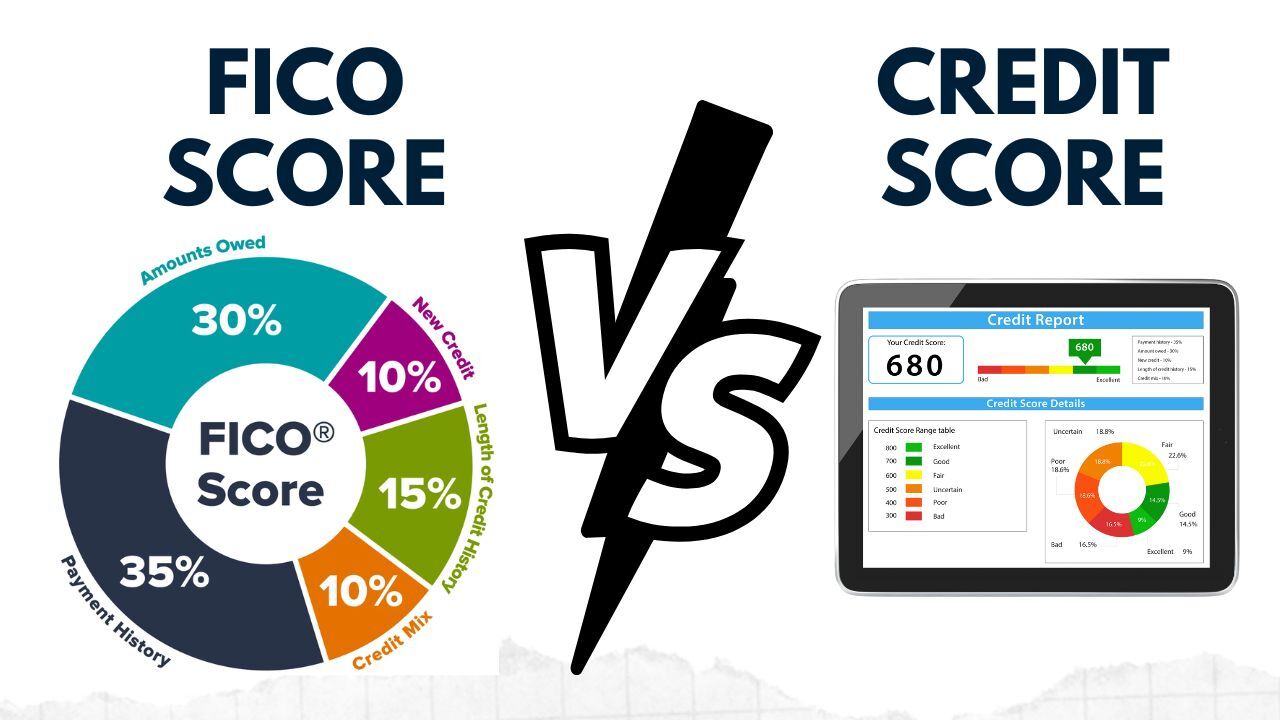

When you are ready to buy a home, it is natural to shop around for the best mortgage rate and terms. But you may have heard that submitting multiple loan applications can damage your credit score and throw a wrench in your homebuying plans. Here is the truth behind hard inquiries, rate shopping, and how to protect your credit while securing the best deal. When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.